1 What is Paypal pay in 4?

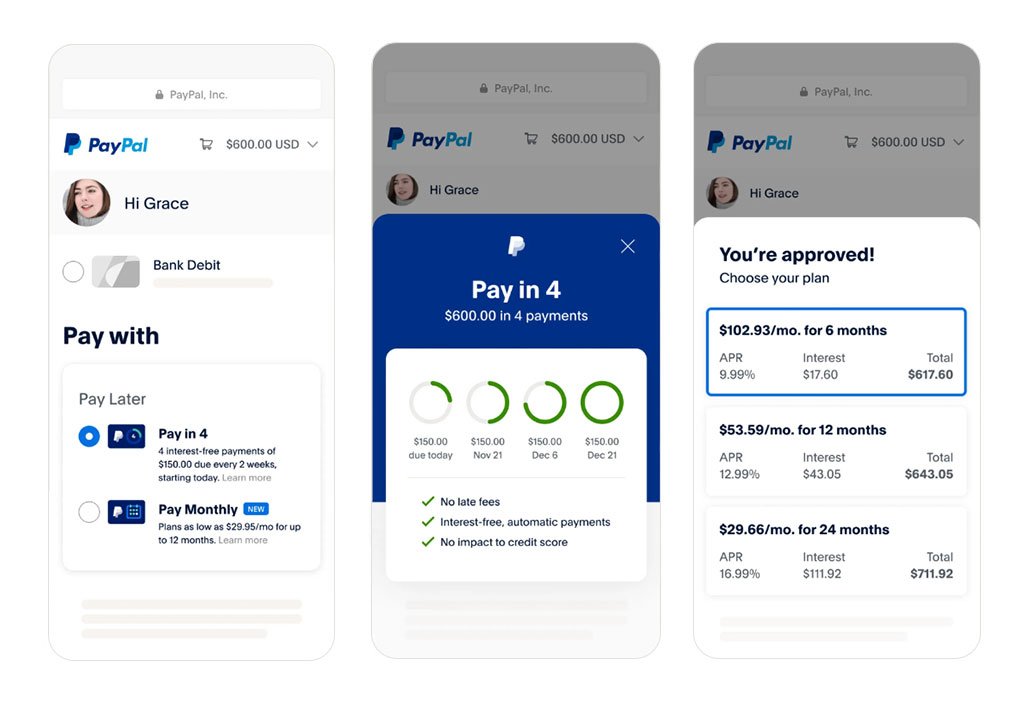

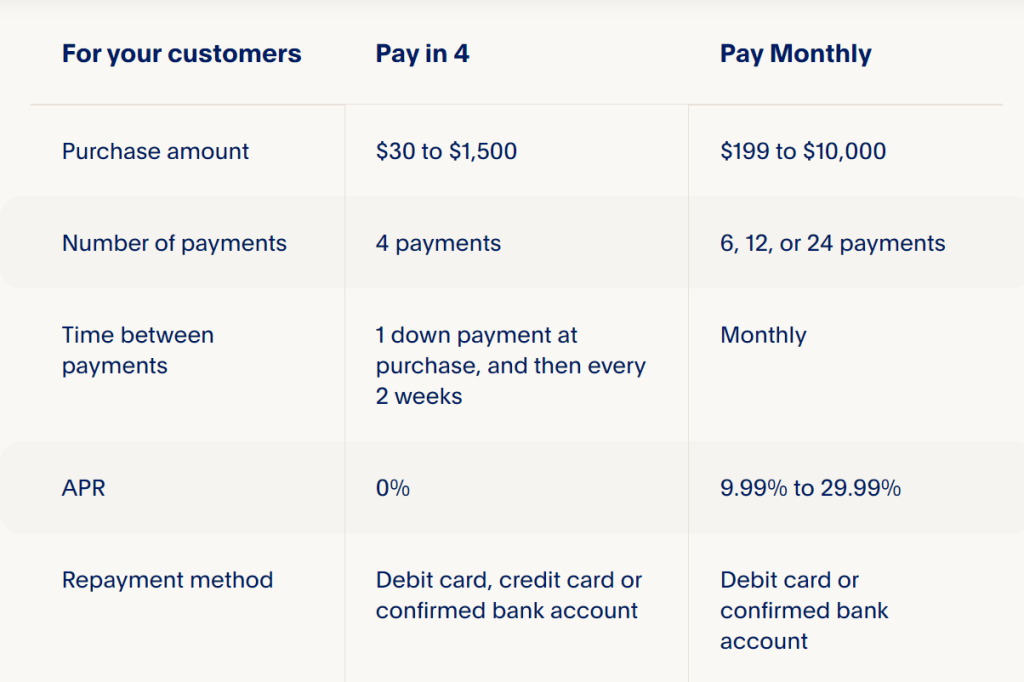

PayPal Pay in 4 lets you split up payments on your purchases at eligible online retailers into four equal payments. You’ll make the first payment upfront and pay the remaining ones every two weeks for a total repayment period of six weeks.

2 Advantages compared to pay monthly

3 Is credit check required for customer?

Proprietary data and credit bureau data may be used to determine a customer’s creditworthiness. For Pay in 4, some consumers may require a soft credit check that does not impact their credit scores. Pay Monthly is subject to consumer credit approval.

4 What purchase amounts qualify for Pay in 4?

5 People who can use Paypal pay in 4

PayPal is offering Pay in 4 to US, UK, DE, FR, AU, ES & IT customers now. You must be at least 18 years of age (or the age of majority in your state) to apply. You must also have a PayPal account in good standing or open a PayPal account in order to apply.

If you choose Pay in 4 as your payment method when you check out with PayPal, you will be taken through the application process. You will get a decision instantly but not everyone will be approved based on our internal checks.

6 The steps of payment

Step 1: Add item(s) to your cart and head to the checkout.

Step 2: Choose PayPal at checkout, then tap Pay Later before selecting Pay in.

Step 3: Get a decision in seconds and make your first payment to complete the purchase.

Step 4: Finish the remaining 3 payments, one every two weeks, in the app or online.

If you have any question,please feel free to send email to qidollservice@outlook.com.